Financing system change

Curator:

Illustration: Matej Klíč

1. Why does the financing of systemic change need a reshuffle?

1. Why does the financing of systemic change need a reshuffle?

Systemic development struggles to be implemented and tested at scale as conventional financing mechanisms are not tailored for the paradigm. System and portfolio interventions are not single-point solutions, so their financing must be more complex, too. System change mainly needs high degrees of independent decision making in how to allocate resources.

Rather than allowing donors to guide and influence priorities at the portfolio level, it is up to the operators (and their stakeholders) who have a deep contextual knowledge to define what interventions deserve resources, and in what forms. Operators should be, de facto, system investment strategists and managers.

2. A key initiative to follow

2. A key initiative to follow

If you want to see how the financing of complex interventions might work, follow the activities of this key initiative.

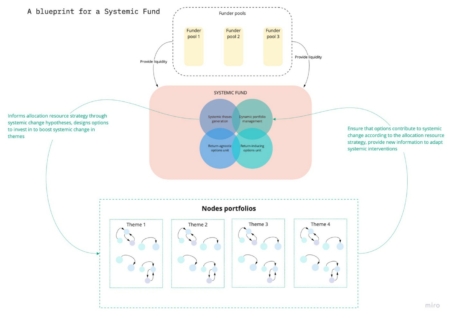

The UNDP has been exploring system and portfolio-based financing models that would allow us to fully leverage the role of financial capital in addressing complex development challenges. For the past year, the UNDP together with other organisations has been uncovering different approaches to financing mission-driven sustainability transitions and portfolios, instead of individual projects. As a result, the UNDP created the concept of a multi-asset Systemic Fund, which has the mandate to develop a portfolio of interventions and flexibly deploy different types of financing depending on the nature of the option to be invested in – from short-term grants to impact- and return-driven equity or credit investments. In contrast to project-based financing, a Systemic Fund designs and invests into entire portfolios at once, with the goal of nurturing development from a systemic perspective. Read more about the Systemic Fund in UNDP Innovation’s article.

Read more 3. Work on the ground

3. Work on the ground

What's our experience with new ways of financing portfolios and system change? See the UNDP's latest interventions in different parts of the world.

5. Become familiar with system and portfolio practice

5. Become familiar with system and portfolio practice

Understand the system level changes that won’t be possible in the immediate future, and why that’s so.

5. Let's think together

5. Let's think together

The community and landscape on financing system change is constantly growing, as different organisations are exploring ways to move beyond the traditional ESG investing towards a more transformative system and portfolio-based investment model. Some of the questions that are being surfaced through these initiatives include:

- What assets do we need to fund, and how do we identify these sensitive intervention points and “system-shifting ventures” if the goal is not just to generate a financial return and reduce emissions, but also to e.g. strengthen resilience?

- How do we move from funding single-point solutions to funding the wider infrastructure and ecosystems that enable others to develop their own solutions collaboratively?

- What is the underlying financial regulatory infrastructure that will make it possible to create a Systemic Fund, regardless of the particular issue it addresses and the form it takes?

- How do you bring a human-centred approach and sensemaking to the practice of investing, and dynamically manage the Systemic Fund and govern the ecosystem of investors around it?

- When the responsibility is shared between project executors, how will we set up an effective and reliable governance and accountability of projects? What tools and protocols do we need in place to be sure that all resources are spent well and with good purpose?

6. What to read/ watch/ listen

6. What to read/ watch/ listen

| 🤏🏻 Beginners | 💪🏻 Advanced |

| 📰 Blog: Cassie Robinson She describes herself as the one “not interested in maintaining the status quo.” Cassie Robinson has a rich experience of innovation in funding and working with various funding organisations. In her blog, she combines daily personal contexts with professional insights on funding innovations and strategies. | 📰 Blog: Dark Matter Laboratories Dark Matter Lab is a multidisciplinary design team developing new working methods for system change. We recommend reading the insights they share on their Medium blog – especially the series Bridging the Impact Investment Gap (part I, II and III) about meaningful ways of financing transformations, and the article about financing sustainability transitions. |

| 📚 Book: Give people money Could universal basic income (UBI) change the world and solve the poverty issue? Economics writer Anne Lowrey has travelled the world to find out how UBI could work in different conditions, as well as the biggest challenges and pitfalls of this policy. | 📜 Study: Finance for a regenerative world, Act III: Reimagining finance If you would like a real deep dive into the topic of approaching the current crises and their financing, read this complex study by the unconventional economist John Fullerton. Besides an explanation of regenerative finance, you will have a chance to think about many provocative ideas and to understand that “we don’t live in an era of change; we live in a change in era.” |

| 🎙️ Podcast: Freakonomics radio In this podcast, Stephen J. Dubner, co-author of the Freakonomics books, introduces and discusses alarming topics and adds an economic insight. His interviews with Nobel laureates, intellectuals and entrepreneurs are great “snacks for the brain” for everyone, not only for those working in the finance sector. | 📰 Blog: Dominic Hofstetter Dominic Hofstetter is part of TransCap Initiative, a collaborative space for developing, demonstrating and scaling system fund in cities, landscapes and coastal zones. In his blog, he writes about tackling climate change and new logic in systems thinking and finance practice. Read one of his recent articles to learn, for example, how a public equity component could make a strategic contribution to a system-based investment portfolio that intends to drive structural change in a real-economy system. |

| 📚 Book: Factfulness The book of Swedish academic and world-renowned public speaker Hans Rosling, with the subtitle Ten Reasons We're Wrong About the World – and Why Things Are Better Than You Think, brings a bit of optimism into daily reality through challenging the common answers to the serious questions. | 📜 EIT Climate KIC's systemic investing for sustainability Transformation Capital is a collective effort providing a holistic investment logic, guiding the deployment of financial capital for the purpose of catalysing sustainability transitions while generating commensurate financial returns. Read the study to learn more about the limitations of traditional funding in systemic change and the need of sustainable finance. |

| 🎙️ Podcast: Systems thinking for climate finance Kirsten Dunlop, Chief Executive Officer of Climate-KIC, and current TransCap Initiative lead Dominic Hofstetter discuss why adopting a systems-thinking perspective is key to approaching the climate crisis meaningfully. | 📜 Report: Embracing complexity Catalyst 2030 is a shared experience involving several organisations, such as McKinsey, Echoing Green, the Skoll Foundation and others. The report is targeted to people from the funding community who want to evolve their current model to invest in system and portfolio approaches. |

| 🔍 Framework: Our impact finance R&D program by Griffith University Yunus Centre An innovation centre from Griffith University introduces their “sensemaking framework, that can enable diverse and distributed stakeholders to align their efforts around complex goals and experiment with new approaches.” |

7. For deeper learning

7. For deeper learning

The following is a list of webinars, lectures and talks for everyone who is dealing with the topic of financing transformation and related issues on a daily basis.