Financing systems change

Portfolios help changemakers to shift from the logic of single-point interventions to coherent, systems-oriented action – easing the path to long-term transformation. However, catalysing systemic change is impossible so long as financing schemes remain conventional.

Project-based financing is often tied to vertical relationships, which means it can become myopic, or simply unable to act as a catalyser in very complex systems – which all societies are. Most development finance remains biased towards projects and single-point interventions based on the logic of predicted cause and effect, and is often skewed towards grant making. It therefore lacks flexibility and does not accommodate uncertainty.

The gap between the system science behind portfolios and the traditional way of funding thus jeopardises the ability to strive for a real change in development. New funding schemes that support a systems approach are needed.

Systemic funds for development – which are multi-asset in nature – may be part of the solution. Systemic funds are pooled investment vehicles that have the mandate and intent of allocating resources to systemic interventions with a multi-asset strategy for development. So, what’s different about systemic funds?

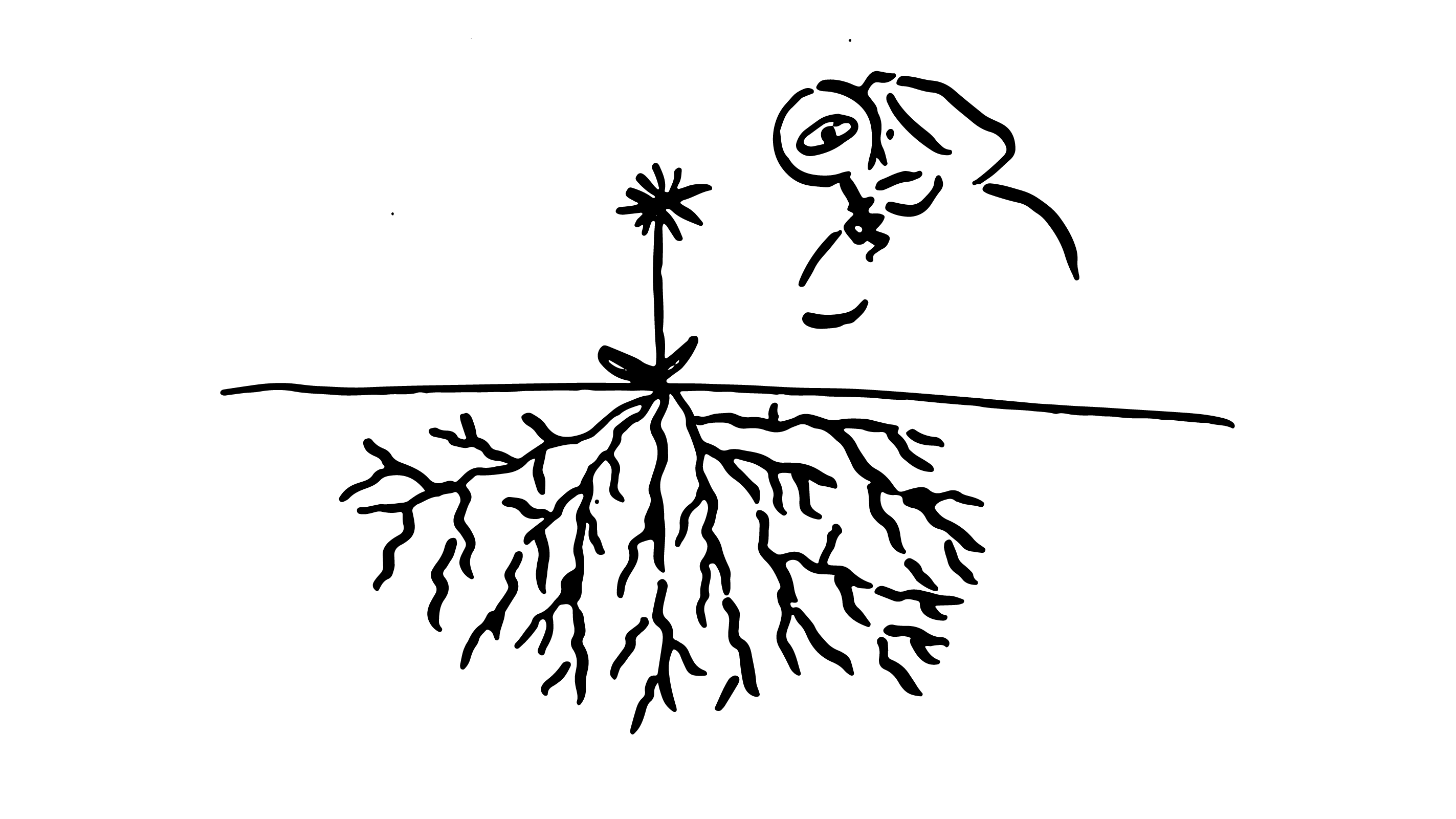

Portfolio of options to transform food systems in the Southern Thailand region.

Portfolio of options to transform food systems in the Southern Thailand region.

A training program in the food industry and efficient services for food certification are some of the interlinked interventions deployed in Southern Thailand by the UNDP and its partners. In a rural region where conflicts and environmental degradation have strongly impacted communities, the UNDP is building a portfolio focused on transforming local food systems. While still in co-creation mode, systemic investments have already been applied to fund the portfolio – using a range of diverse financing tools.

1. Financing portfolios of options

Usually, development is biased toward project-based funding: donors allocating grants for thematically defined, often short-term projects. Instead, a systemic fund brings together several funders – both private and public – in a funding scheme of a different kind.

Liquidity pooled from the allocations of multiple donors, and managed by the systemic fund, is invested in portfolios of options: interlinked interventions with the aim of igniting a long-term transformation in the community.

These options are intrinsically interlinked, with resources allocated from the same pool of funders. A systemic fund cannot therefore invest in a single intervention; various options can be funded in groups of two, three or more. But this also urges the fund to explicate – with a consistent narrative – how the options affect each other, thus underlining the systemic nature of the investment.

Re-designing local food markets with public investments

The physical redesign of local markets is another option deployed in Southern Thailand to improve the quality of food systems. The option is financed using infrastructure investment, with local public institutions acting as co-investors, and managed by a systemic fund. The option is interlinked to other activities of the portfolio – such as setting up digital strategies for food – and so are the fundings.

2. Cherry-picking the right financing tool

A portfolio of interventions needs a diverse set of financing instruments – from conventional grants to asset classes such as credit, equity and real estate, to name a few.

Development financing on the other hand is often everything but multi-asset, using grants as the only tool to fund a broader range of different activities, regardless of their nature: infrastructure retrofitting, for instance, or capacity building.

Societies are complex adaptive systems. Their dynamics are non-trivial, and some interventions would have a greater impact when combined and leveraged by other investments. A systemic fund should be flexible enough to use the right financial tools for the right intervention – depending on the nature of the option, the needs of the context and the desired outcomes.

3. Donors committed to system change

Funder pools are sets of public or private investors – or both – interested in investing in the systemic fund.

While funder pools aggregately provide liquidity to the fund, they may differ in preference on where and how their money should be allocated. This is quite common: funders may have preferences in terms of financial instruments (e.g. some may want to fund only grants, others only equity), they might want to finance transformation in specific countries or work within a topic, such as education or sustainability. Institutional funds are quite familiar with the scenario. The European Investment Fund, for example, features a wide variety of equity and debt instruments with several degrees of specification.

Whatever the key propositions of an investor might be, it is crucial that all the donors embrace the systemic nature of the fund.

4. The fund is independent from specific stakeholders

In its resource allocation, the systemic fund does not feature any strict direct control or veto from the funder pools. This is the real core of the fund and its actual strength: the ability to operate independently from specific stakeholder interest in designing investment hypotheses and all the portfolios of options that follow.

However, specific co-investors may have a bias towards certain outcomes and thereby influence the nature of the portfolio they co-finance. To mitigate the risk, it is vital to establish transparent governance processes and to decide how co-investment decisions are performed.

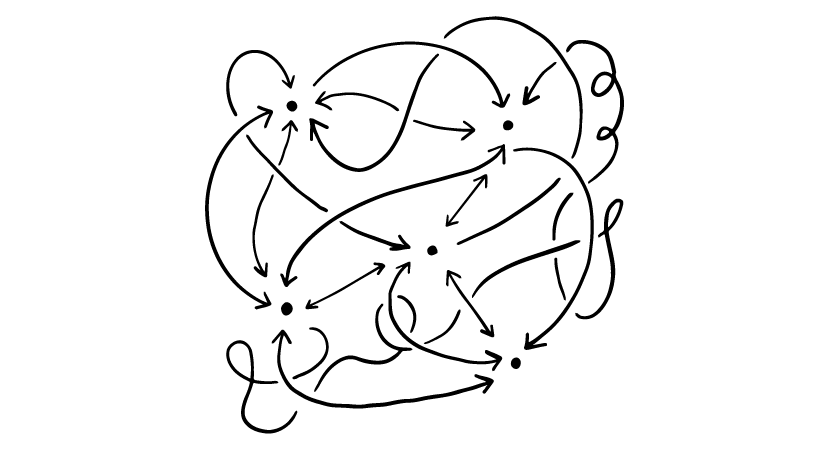

How does a systemic fund work?

Funder pools provide liquidity to the systemic fund. The fund shapes investment hypotheses to boost systemic change in communities and turn them into portfolios of options. The fund also ensures that options contribute to the desired long-term transformation and provide new information to adapt both the interventions and the allocation of funding.

5. New knowledge dynamically shapes investments

Similar to a multi-asset management firm in mainstream finance, a systemic fund is devoted to developing and testing investment hypotheses that bring systems change into a community.

Reasonable hypotheses are turned into portfolios of options, where each option is financed according to the most suitable financing instrument.

Yet, complex challenges are characterised by uncertainty. Tweak one variable, and it could completely change how, when or whether the desired change will actually occur. Not all outcomes can be linearly planned for, but on the other hand, acquiring new knowledge about communities is a valuable asset. Through the portfolio, the fund acquires new knowledge about the state of a system – meaning both investors and changemakers learn more about the community they are working with, and the consequences of the interventions.

The systemic fund should be ready to adapt to new information, thus generating novel investment hypotheses or changing capital deployment in existing options.

How does a systemic fund work?

Funder pools provide liquidity to the systemic fund. The fund shapes investment hypotheses to boost systemic change in communities and turn them into portfolios of options. The fund also ensures that options contribute to the desired long-term transformation and provide new information to adapt both the interventions and the allocation of funding.

Narratives – with quantitative and qualitative KPIs

The outcomes of the portfolios of options are managed, measured and made evident to the stakeholders to which the fund is accountable. Namely, both the investors and the communities.

Just as with any portfolios in asset management, systemic funds also track their overall dynamics and performance by leveraging metrics (quantitative and qualitative) that have been determined before the investment.

Therefore, the fund needs clear narratives that explain how portfolios of options interact and how they are expected to ignite long-term transformation. The narratives are informed by the process of generating systemic theses that lead to the options. In black and white, narratives are put into clear and traceable quantitative and qualitative KPIs.

Illustrations: Ivana Cobejova, Matej Klíč

Photos: Shutterstock

Source: Concept Paper - Deploying Systems Finance for Development